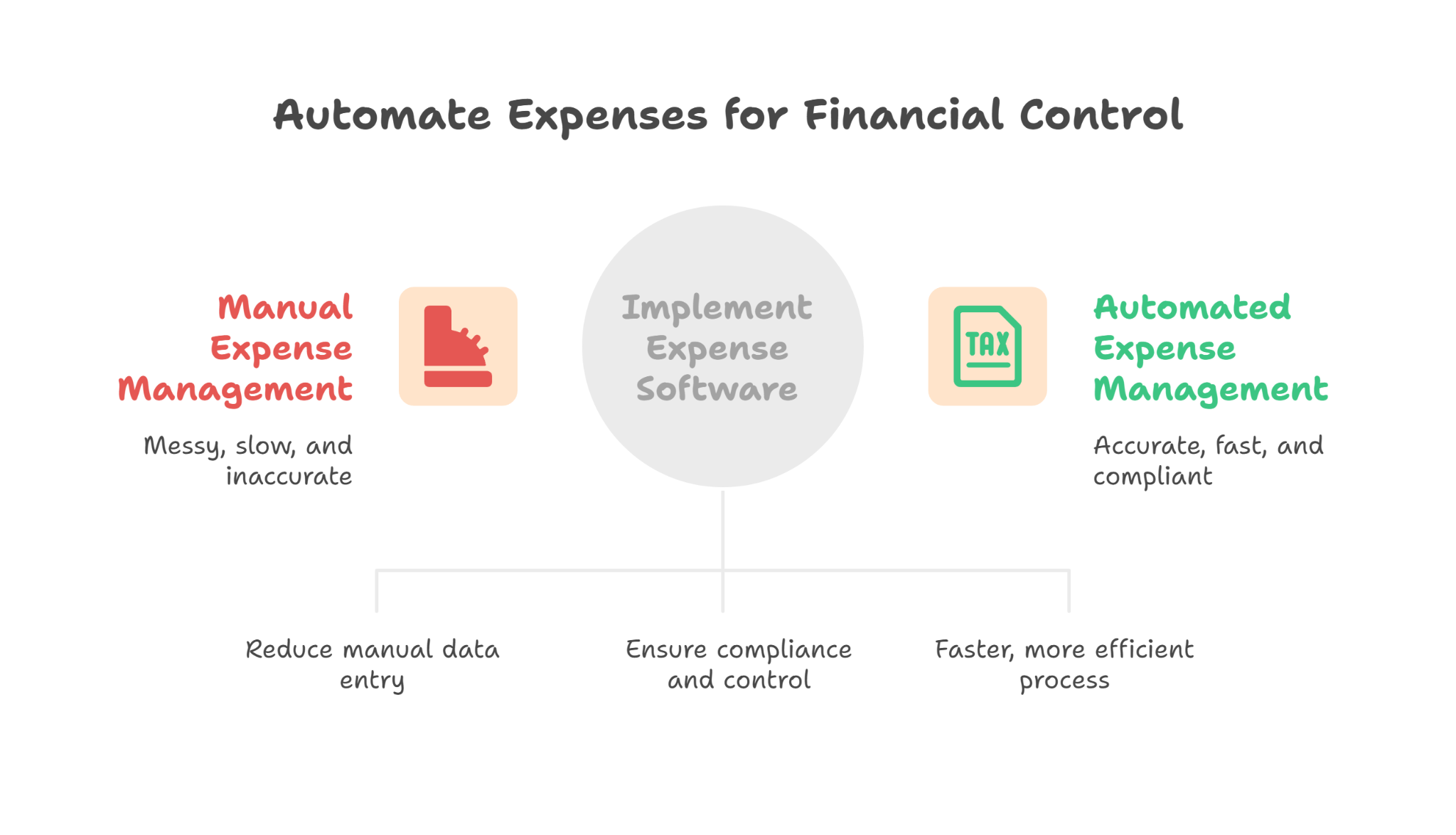

How can financial control be tightened up fastest, without slowing the business down? In most organizations, the key to tightening financial control is taming the messy, manual world of employee expenses. Spreadsheets, taped receipts, and ad hoc approvals give way to blind spots that leak cash and translate to month-end stress silently. Effective expense management software enables automation, replacing friction with accuracy, speed, and policy compliance.

1) Real-time visibility beats end-of-month surprises

If finance only sees costs when claims arrive at month-end, you’re already behind. Automated capture pipelines let managers view spending as it happens. With Digital Expense Management, every taxi fare, client lunch, and field visit updates the dashboards in near real time, which enables proactive course corrections rather than reactive cleanups. When visibility is continuous, accruals are accurate, and forecasts become more precise.

2) Policy compliance—enforced, not just documented

You probably have a policy PDF. But do people follow it? Automation embeds rules directly into submission workflows. Per diem caps, receipt thresholds, mileage rates, and category restrictions are applied automatically. Expense Claim Management Software quickly identifies claims that don’t follow the rules as they are submitted, highlighting issues early and preventing potential losses before they show up as expenses in the records—the upshot: fewer write-offs, fewer awkward conversations, and tighter control.

3) Paperless, faster, and audit-ready

Ask yourself: how much time does your team spend chasing missing receipts? Paperless Expense Reporting turns the camera into a scanner, extracts data instantly, and attaches the source document to the claim. That creates an audit trail auditors actually like: line-level evidence, consistent categorization, and time-stamped approvals. And when regulators (or your own internal audit) come calling, you’re days ahead—not scrambling for shoeboxes.

4) Time back for everyone (not just finance)

Manual expenses waste time at every step: employees filling forms, managers checking math, and finance rekeying data. A robust system for managing employee expenses streamlines the whole chain—auto-capture, auto-categorize, and auto-route. Employees submit on the go; managers approve in clicks; finance reconciles with confidence. That time dividend compounds across the year, freeing teams to focus on revenue, not reimbursement admin.

5) Faster reimbursements, happier teams

There is nothing that deflates morale like waiting weeks for reimbursement. Automation reduces the time interval between submission and payout. When using Digital Expense Management Software, validated claims can automatically sync to payroll or AP on a predetermined basis, with fewer follow-ups on when a reimbursement will occur. Managing money isn’t all about saying no; it is about enabling timely, predictable yes.

6) Cleaner books via seamless integrations

Control unravels when systems don’t talk. The best expense management software integrates with HRIS (for active headcount and cost centers), calendars (to validate trips and events), mapping (for accurate mileage), and accounting/payroll (for coding and payout). Such integration removes reconciliation gaps and ensures every approved claim lands in the right GL, on time, with the proper tax treatment.

7) Data you can actually use

Every receipt is a data point. Over time, trends emerge: which teams spend above peers, which vendors dominate, and which categories creep. Digital expense management improves the experience by turning past spending into useful information with customizable reports, spotting unusual spending, and comparing expenses over different times. Use it to consider renegotiating vendor rates, refining travel policies, or introducing smarter per diems. Ideally, integrate insights into budgets and forecasts to establish a positive control loop.

8) Fraud reduction without slowing the honest majority

Controls shouldn’t punish successful actors. Automatic validations such as duplicates, merchant verification, and weekend/holiday validation will occur in the background behind Expense Claim Management Software. Most are passed; suspicious ones are run up with context. Finance focuses on exceptions, not the entire haystack, preserving speed for everyone else.

9) Mobile-first experience employees actually adopt

Adoption is everything. If submitting a claim is easier than ignoring it, people will comply. Paperless expense reporting allows users to capture expenses at the taxi door, the hotel desk, or the café table. Add smart reminders and saved preferences, and completion rates rise while late claims fall. The result: cleaner period closes and fewer accrual headaches.

10) Built-in readiness for tax and local rules

Multinational teams must contend with VAT/GST regulations, threshold amounts per country, and special categories. An effective employee expense management system integrates the local details without employees having to memorize them. Finance gains consistent coding, and audits proceed smoothly—no last-minute scramble for missing VAT numbers or corrected tax categories.

How a modern platform supports control without friction

A well-designed digital expense management software platform balances ease for employees with rigor for finance: mobile capture, policy engines, automated routing, analytics, and tight integrations with payroll and accounting. Pair that with role-based approvals and granular audit trails, and you get end-to-end control that scales with your headcount and footprint—without adding headcount to finance.

Mom Digital fits this vision, as it has a dedicated solution for managing work expenses and a more comprehensive workforce/HR system that centralizes data and processes to reduce rekeying, improve compliance, and accelerate close cycles.

Conclusion

Financial control is successful when an automatic process is in place, real-time data and policy are enforced at the point of entry. Organizations can minimize the losses, accelerate reimbursements, and feel safe about their financial processes, using expense management software, such as Digital Expense Management, expense claim management software, Paperless Expense Reporting, an Employee Expense Management System, and new Digital Expense Management Software.

To accelerate your pathway to expense management using a complete, integrated solution that teams use, Mom Digital can deliver solutions that integrate expense workflows with the rest of your workforce operations to deliver precision, speed, and governance at scale.

Save 10+ hours/week with AI automation -Automate payroll, leave management & compliance

Save 10+ hours/week with AI automation -Automate payroll, leave management & compliance