Payroll in multiple countries is like juggling burning torches: the slightest mistake may result in company non-compliance, unhappy workers, and excessive budgetary expenditure. Have you ever thought about how top organizations make everything work? So what are the main multi-country payroll issues right now, and how does a powerful payroll management software within an HRMS address each of them directly?

Challenge 1: Navigating Complex Compliance Requirements

All countries have tax withholding codes, statutory deduction rates, end-of-year reporting, and so on. Missing a rate payment or failing to meet a deadline may result in large fines.

How an HRMS Helps

- Automated Updates: A dedicated Payroll Compliance Softwaremodule keeps local regulations up to date without manual research.

- Built-In Checks: Validation rules flag potential errors—like incorrect tax codes—before payroll runs.

- Centralized Reporting: Generate compliant reports tailored to each jurisdiction in seconds.

- Interactive Tip:Have you set up country-specific approval workflows? With the right tool, you can route exceptions to local experts before payments are issued.

Challenge 2: Managing Multiple Currencies and Exchange Rates

The other aspect of the complexity taps into the fluctuating exchange rates and currency conversions, especially with employees who earn a currency equivalent to their compensation but pay their taxes in a different currency.

How an HRMS Helps

- Real-Time Conversion: Integrated Electronic Payroll Systems pulls live exchange rates, ensuring net pay calculations are always accurate.

- Rate Lock-Ins: Lock in favorable rates for a pay period to avoid surprises.

- Automated Reconciliation: Compare amounts disbursed vs. amounts debited in each currency, all within the same dashboard.

Did you know? Automating currency conversions can cut reconciliation time by up to 70%.

Challenge 3: Ensuring Data Accuracy and System Integration

Payroll relies on data from time-tracking, benefits, and expense management systems. Disparate data sources can lead to mismatches, delayed pay, and frustrated staff.

How an HRMS Helps

- Unified Platform: A single payroll management software hub integrates with time & attendance, benefits administration, and more.

- Data Validation: Cross-module validations prevent mismatched hours or missing employee profiles.

- Self-Service Portals: Employees can update personal details directly, reducing HR’s data-entry burden.

- Quick Poll: How often do you reconcile payroll data errors manually? With end-to-end integration, manual fixes become a thing of the past.

Challenge 4: Handling Different Payroll Cycles and Time Zones

Weekly, bi-weekly, and monthly cycles across time zones can lead to missed deadlines or rushed processes.

How an HRMS Helps

- Flexible Scheduling: An Electronic Payroll Systemlets you set up multiple pay cycles per country or region.

- Automated Reminders: Receive alerts based on local cutoff times, so you never miss a run.

- Global CalendarView: See all upcoming payroll dates in one consolidated interface.

- Pro Tip: Align payroll runs with local banking schedules to ensure timely deposits.

Challenge 5: Controlling Costs and Budgeting Accurately

Without visibility into labor costs by region, it’s hard to forecast budgets, especially when headcount shifts or benefits change.

How an HRMS Helps

- Cost Allocation: Track salaries, taxes, and benefits in real time, then allocate costs by department or country.

- Forecasting Tools: Use built-in Budget HRMS Software features to model “what-if” scenarios before approving hires or pay raises.

- Spend Analytics: Dashboards highlight areas of overspend, enabling proactive budget adjustments.

- Interactive Checklist: Which of these cost-saving measures have you implemented? (1) Automated tax filings, (2) Self-service enrollments, (3) Real-time cost dashboards.

Challenge 6: Maintaining Security and Data Privacy

With sensitive payroll data traversing borders, ensuring confidentiality and regulatory compliance (e.g., GDPR) is paramount.

How an HRMS Helps

- Role-Based Access: Limit who can view or edit payroll details based on user roles.

- Encrypted Data: End-to-end encryption safeguards data at rest and in transit.

- Audit Trails: Comprehensive logs show who accessed or modified records, when, and why.

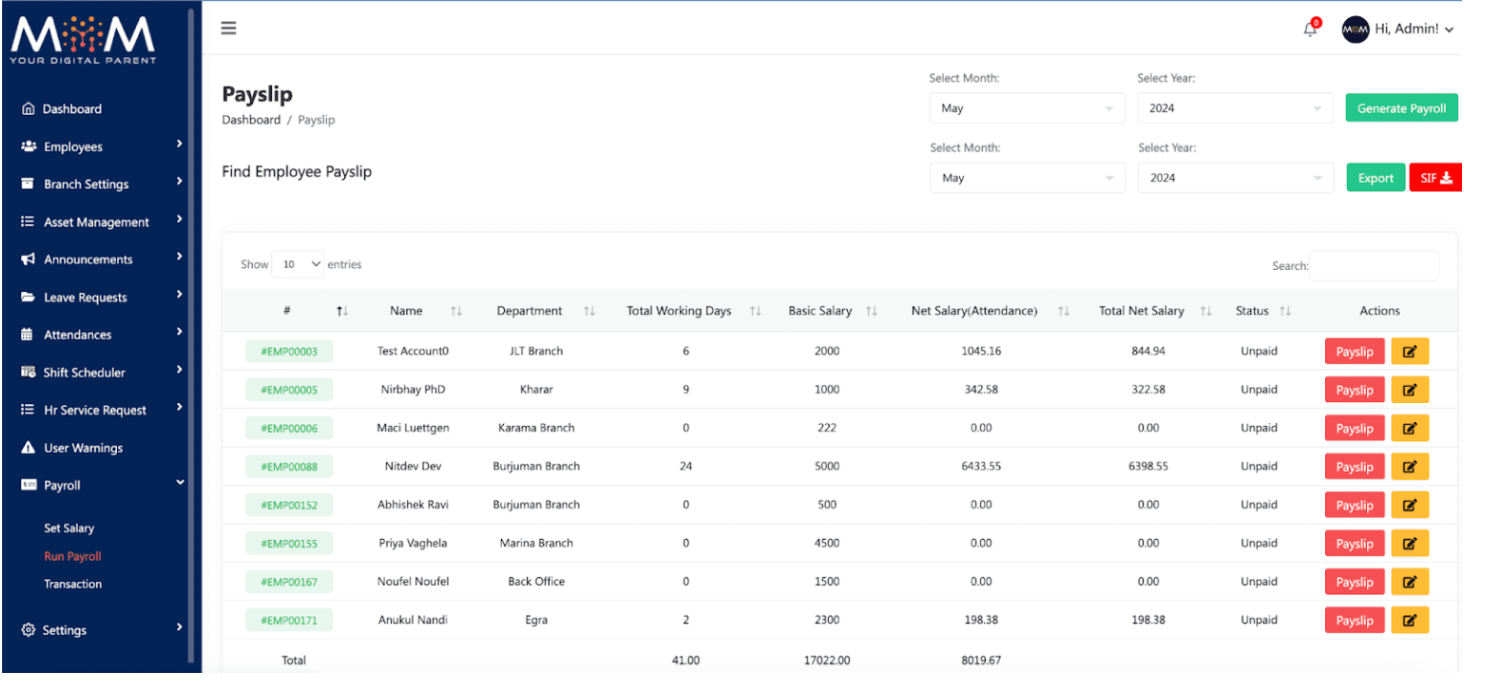

Bringing It All Together with Digital Payroll

With Digital Payroll and a packed payroll compliance engine, HRMS is what turns payroll from a pain into a competitive leverage. With the use of Electronic Payroll Systems, businesses can easily expand into new markets, add employees, process deductions, and close payroll periods with assurance.

Why Choose momdigital?

Are you ready to run your global payroll faster, more accurately, and with more time to give your HR team more value add? How to set up the end-to-end HRMS that Momdigital provides, including a built-in, user-friendly Electronic Payroll System that fits your specific multi-country requirements.

Conclusion

Payroll in multiple countries should not be a payroll nightmare of spreadsheets and manual updates. Organizations can become masters of compliance, expert cost-management, and timely pay by adopting a unified HRMS that comes complete with proven payroll management software, Digital Payroll capabilities, and Budget HRMS Software functionality. Find the difference with momdigital.

Save 10+ hours/week with AI automation -Automate payroll, leave management & compliance

Save 10+ hours/week with AI automation -Automate payroll, leave management & compliance